Status update a week after introduction of Trump steel tariffs

A great deal can happen in a week. And it has! It’s now just one week since the President Trump’s controversial tariffs of 25% on steel and 10% on aluminium were introduced. After initial panic and market tumbles, the situation appears to be settling. Although, the tariffs continue to attract criticism at home and abroad, fears of a trade war are easing[1]. And comments by Voestalpine, S+B typically underplay Section 232, as the group says that the duties would hurt only 3% of their direct sales of products made in Europe[2].

Unpopular at home and abroad

Even though EU nations have been exempted, other countries around the globe continue to object. The head of Turkey’s Steel Exporters Association, Namik Ekinci, for example, was quoted by the BBC as saying he felt Trump had dealt a “great injustice” to Turkish manufacturers[3].

And it’s not just global partners who are unhappy. In the US, the tariffs are also coming in for criticism at the highest level. Even before the tariffs came into effect, the president’s top economic adviser Gary Cohn, a supporter of free trade, resigned and more than 100 Republicans signed a letter to the president, expressing their “deep concern” about the impact his policy could have on the economy[4]. This past week, in an interview with cnbc, former US Treasury Secretary, Larry Summers, believes because of the potential retaliation from China “risks to the American economy from the steel tariffs are far greater than the risks from the absence of the steel tariffs.” Even commenting that the Trump administration was effectively “shooting itself in the foot”[5].

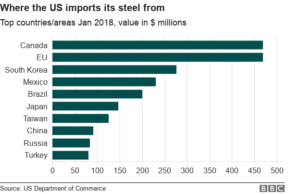

The world’s largest steel importer

With import levels up 134% since 2009 to a record 34.6 million metric tons in 2017, the US is the world’s largest steel importer[6]. With leading exporters like Canada and the EU, exempted, the impact is greater on other suppliers.

China

In an initial reaction, Beijing suggested it could retaliate by targeting 128 US products, including steel, with an initial modest import value of $3 billion[7]. However, Chinese steel futures rebounded this week, supported by production restrictions and easing fears of a trade war.[8]

Monitoring the impact

The ongoing uncertainty continues, as negotiators at the WTO work to prevent further escalation. Steel Solutions is maintaining our dialogue with stakeholders in Asia and Europe. We will keep our partners and clients informed of developments.

Contact us

To discuss the latest developments and assess your options, contact us at:

info@steel-solutions.nl Phone: +31 (0)43 6096200

About the author

Wibo Feijen BSc (1972) was born and raised in the steel industry, learning the ins and outs of the sector in his father’s European steel business. In 2014, he founded Steel Solutions, which now provides expertise in a network of companies that produce, process, market and transport steel in Europe, the Americas and Asia. Based in the Netherlands, Steel Solutions takes care of the entire logistics process that connects European and non-European steel suppliers to steel processors and users in the heart of the steel industry in Europe.

[1] kallanish.com

[2] kallanish.com

[3] www.al-monitor.com

[4] www.bbc.com

[5] www.cnbc.com

[6] www.trade.gov

[7] www.cnbc.com

[8] kallanish.com

Why choose Steel Solutions

Expertise & services

Strategic located hub